BILLIONAIRE fortunes increased by 12 percent last year – or $2.5 billion a day – while the 3.8 billion people who make up the poorest half of humanity saw their wealth decline by 11 percent, reveals a new report from Oxfam. The report is being launched as political and business leaders gather for the World Economic Forum in Davos, Switzerland.

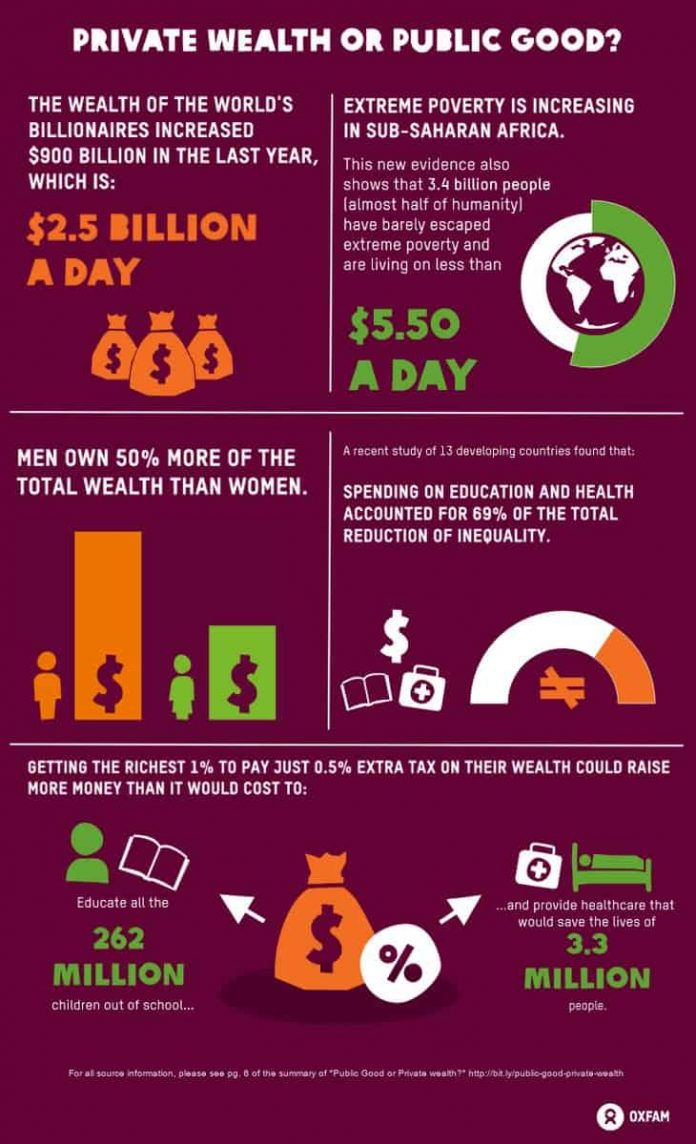

BILLIONAIRE fortunes increased by 12 percent last year – or $2.5 billion a day – while the 3.8 billion people who make up the poorest half of humanity saw their wealth decline by 11 percent, reveals a new report from Oxfam. The report is being launched as political and business leaders gather for the World Economic Forum in Davos, Switzerland.The report also highlighted the contrast between the rich and the poor. For example, it pointed out:

* Mukesh Ambani ranks 19th in the Forbes 2018 billionaire list and is the richest Indian. His residence in Mumbai, a towering 570-foot building, is worth $1bn and is the most expensive private house in the world.

* Pratima, who lives in a slum in Patna, eastern India, lost both her twins due to delays and scarce resources in her nearest clinic. Poor women like Pratima have to give birth without proper maternal healthcare, leaving them vulnerable to complications, neglect and stillbirth as a result.

Winnie Byanyima, Executive Director of Oxfam International, said: “The size of your bank account should not dictate how many years your children spend in school, or how long you live – yet this is the reality in too many countries across the globe. While corporations and the super-rich enjoy low tax bills, millions of girls are denied a decent education and women are dying for lack of maternity care.”

The report reveals that the number of billionaires has almost doubled since the financial crisis, with a new billionaire created every two days between 2017 and 2018, yet wealthy individuals and corporations are paying lower rates of tax than they have in decades.

- Getting the richest one percent to pay just 0.5 percent extra tax on their wealth could raise more money than it would cost to educate the 262 million children out of school and provide healthcare that would save the lives of 3.3 million people.

- Just four cents in every dollar of tax revenue collected globally came from taxes on wealth such as inheritance or property in 2015. These types of tax have been reduced or eliminated in many rich countries and are barely implemented in the developing world.

- Tax rates for wealthy individuals and corporations have also been cut dramatically. For example, the top rate of personal income tax in rich countries fell from 62 percent in 1970 to just 38 percent in 2013. The average rate in poor countries is just 28 percent.

- In some countries, such as Brazil, the poorest 10 percent of society are now paying a higher proportion of their incomes in tax than the richest 10 percent.

At the same time, public services are suffering from chronic underfunding or being outsourced to private companies that exclude the poorest people. In many countries a decent education or quality healthcare has become a luxury only the rich can afford. Every day 10,000 people die because they lack access to affordable healthcare. In developing countries, a child from a poor family is twice as likely to die before the age of five than a child from a rich family. In countries like Kenya a child from a rich family will spend twice as long in education as one from a poor family.

Cutting taxes on wealth predominantly benefits men who own 50 percent more wealth than women globally, and control over 86 percent of corporations. Conversely, when public services are neglected poor women and girls suffer most. Girls are pulled out of school first when the money isn’t available to pay fees, and women clock up hours of unpaid work looking after sick relatives when healthcare systems fail. Oxfam estimates that if all the unpaid care work carried out by women across the globe was done by a single company it would have an annual turnover of $10 trillion – 43 times that of Apple, the world’s biggest company.

“People across the globe are angry and frustrated. Governments must now deliver real change by ensuring corporations and wealthy individuals pay their fair share of tax and investing this money in free healthcare and education that meets the needs of everyone – including women and girls whose needs are so often overlooked. Governments can build a brighter future for everyone – not just a privileged few,” added Byanyima.