DIANE Lebouthillier, Minister of National Revenue, on Tuesday announced that the 2019 tax filing season is officially open. The Canada Revenue Agency (CRA) has now begun processing income tax and benefit returns filed by Canadians in the way that is most convenient for them. Canadians can file their income tax and benefit returns online, on paper, or by telephone for those who qualify.

The objective of the CRA is to give taxpayers the information they need to file their taxes on time and receive the benefits and credits to which they are entitled. No matter how individuals choose to file their tax return, a number of improvements have been made to ensure that tax-filing is a user friendly experience, and continues to be fast, easy and secure.

The CRA claims that this year it has made significant improvements to its call centres, moving to a new modern telephone platform which features improved accessibility for callers. Now when an individual calls, they are given an estimated wait time, allowing them to choose to wait for an agent, call back later, or use one of its convenient self-serve options. The CRA says it has also improved training for call centre agents to ensure that Canadians get the answers they are looking for.

In addition to the many benefits and credits available to Canadians such as the Canada Child Benefit and the Canada Caregiver Credit, new this year is the Climate Action Incentive payment, which is available to eligible residents of Saskatchewan, Manitoba, Ontario, and New Brunswick. Individuals can claim the payment when they file their income tax and benefit return.

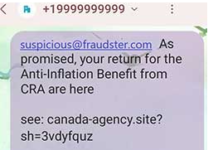

As Canadians get busy filing their taxes, the CRA reminds everyone to be cautious of fraudulent communications. Scammers posing as CRA employees continue to contact Canadians, misleading them into paying false debt. They may be phishing scams, or other fraudulent scams, that could result in identity and financial theft.

Lebouthillier says: “Over the past three years, our Government has put service improvement at the top of our priorities. The new services we have introduced at the Canada Revenue Agency have made it easier, faster and more secure for Canadians to file their taxes. These changes are delivering real results for Canadians. Whether online or on paper, I encourage all Canadians to file their 2018 taxes to claim the credits and benefits to which they are entitled, such as the Canada Child Benefit and the Climate Action Incentive in applicable provinces.”

Quick Facts:

- Most Canadians’ income tax and benefit returns are due on April 30, 2019.

- Self-employed individuals have until June 15, 2019 to file their returns. Since June 15, 2019 falls on a Saturday, the CRA considers your return to be filed on time, if the CRA receives it by or it is postmarked midnight June 17, 2019. However, if you have a balance owing, you must pay it by April 30, 2019.

- March 1, 2019, is the deadline for contributing to a Registered Retirement Savings Plan.

- Canadians should have received most of the tax slips, such as T4s, and receipts needed to file a tax return by early March.

- From now until April 30, 2019, the CRA will be offering extended evening and weekend hours for individual tax enquiries. Approximately 3,000 telephone agents will be available Monday to Friday (except holidays) from 9 am to 9 pm (local time), and from 9 am to 5 pm (local time) on Saturdays (except Easter weekend) to serve as many people as possible. Our automated service will remain available 24 hours a day, 7 days a week.

- By February 11, 2019, the CRA will have mailed the income tax package to individuals who filed on paper the previous year. The new all-in-one 2018 income tax package is improved with simplified language, enhanced information on forms and has a more user-friendly design.

- In addition to the mail out, a limited quantity of tax packages will still be available at Canada Post, Service Canada, and some Caisse populaire Desjardins outlets (Quebec only). Canadians will also find information to order these products by phone or online in the language of their choice in case packages are no longer available in those locations.

- Individuals with a modest income and a simple tax situation may be eligible to have their tax return completed for free through the Community Volunteer Income Tax Program (known as the Income Tax Assistance – Volunteer Program in Quebec). Free tax clinics are offered across Canada during March and April, with some open year-round.

- In October 2018, the CRA appointed its first Chief Service Officer (CSO). The CSO is in charge of leading the CRA’s service transformation through an integrated, client-focused approach.

It is Feb 25, 2019 and I haven’t received my T4A yet. I tried calling CRA and no one could help me. Is there a problem?