THE Conference Board of Canada’s Chief Economist Pedro Antunes, commenting on Monday’s federal fiscal update, said: “[Finance] Minister [Chrystia] Freeland has highlighted the importance of rolling out a vaccine and providing additional support to households and businesses through what will be a tough winter for many Canadians. The additional spending coupled with a lasting negative hit to government revenues will add copiously to the federal debt—boosting the net debt-to-GDP ratio from 35 per cent pre-COVID to around 54 per cent over the medium term. If debt financing costs remain low, the federal government can manage but there’s no doubt that the COVID-19 crisis will constrain federal finances for decades to come.”

Speech Highlights and Insights:

- * In the first proper fiscal update since this time last year, the government outlined broadly its recovery plan as Canada looks to exit the pandemic induced recession.

- * The government deserves credit for expediency of the measures enacted in short order at the beginnings of the pandemic. Additionally, the government is prudently bracing – by outlining multiple scenarios and associated costs – for a tough winter before a successful vaccine is distributed next year.

- * The government expects the deficit to balloon to $381.6 billion this year, with the possibility that the virus resurgence could lead the deficit to reaching $400 billion. Finance Canada currently expects the deficit to be well under control by 2025–26 where the deficit improves to below $25 billion, or $33.4 billion in the case of a virus resurgence.

- * The recovery will be aided by further stimulus over the next three fiscal years to the tune of $70 to $100 billion which were not detailed at this time but will be explored further in the spring. There was no mention of pharmacare or a national day care plan that were hinted at in the September throne speech.

- * In addition, prior to the fall update, the government had tallied an estimate of over $250 billion this year and around $30 billion in new direct measures next fiscal year. This update added $22 billion each this year and next, which is separate from the unspecified stimulus discussed in the previous bullet.

- * New measures include:

- Wage subsidy increased and extended to June 2021 ($15 billion this year, $16 billion next)

- Canada Emergency Rent Subsidy ($2 billion this year)

- Support for arts (182 million next year), air sector (540 million next year), and credit availability for tourism sector

- Overhauling tax system by closing loopholes (7 billion over 5 years)

- Nearly tripling the fiscal stabilization cap from $60 per capita to $170 per capita.

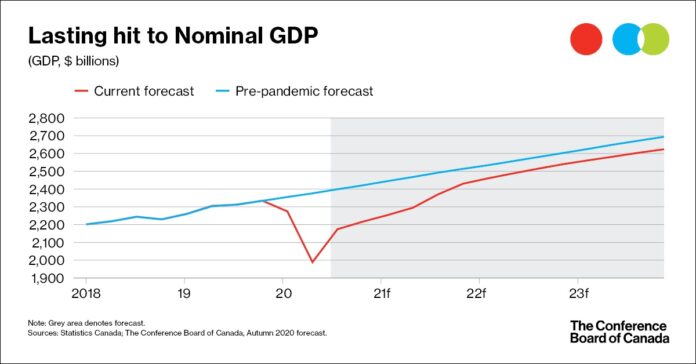

- * To give context of how hard-hit revenues will be this year we can compare the outlook for nominal GDP in our latest forecast to our pre-COVID forecast completed in December 2019 (see chart). Over the four-year period displayed, the loss in nominal GDP sums to $500 billion—a substantial hit to profits, household incomes and government revenues.

- * Overall, the government expects a string of deficits that will total $597 billion from 2020-21 to 2023-24, not including the $70 to $100 billion additional stimulus.

- * Federal government debt is forecast to be manageable despite the significant increase as the government can finance these new measures at rock bottom rates. There is a risk, however, that bond yields could rise above what the government expects, given the massive increases to government debt issuance in Canada and globally.

- * Canadian taxpayers will also be liable for record provincial deficits—we expect federal and provincial net debt to reach $2 trillion or over 92 per cent of GDP, levels not seen since the early 1990s.