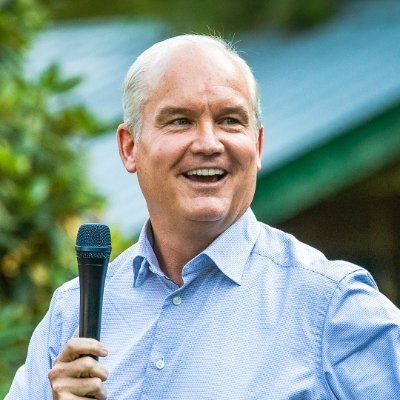

CONSERVATIVE Party Leader Erin O’Toole on Sunday in Saint-Hyacinthe, Quebec, introduced his plan to rebuild Main Streets across the country and help small businesses get back on their feet and create jobs.

“Canada’s small businesses employ millions of people and have been hit hard by the pandemic,” O’Toole said. “They need real support to help rebuild or restart their business and hire back workers – and that’s exactly what Canada’s Recovery Plan will deliver.”

To restore the one million jobs lost during the pandemic and rebuild Canada’s Main Streets, a Conservative government will introduce the Rebuild Main Street Tax Credit. The new incentive will give Canadians an opportunity to support small businesses by providing a 25-per-cent tax credit on amounts of up to $100,000 that someone personally invests in a small business over the next two years.

A Conservative government will also introduce the Rebuild Main Street Business Loan, which will immediately make available interest-free loans of up to $200,000 to help small and medium businesses, with up to 25 per cent forgiven depending on revenue losses. These loans are significantly more generous than the Liberals’ $60,000 Canada Emergency Business Account loan, which fell short of the needs of thousands of eligible businesses.

In addition to the Rebuild Main Street Tax Credit and the Rebuild Main Street Business Loan, Canada’s Conservatives will introduce a Canada Investment Accelerator tax credit, which will provide five per cent back for any capital investment made in 2022 and 2023, with the first $25,000 to be refundable for small businesses.

“Canadian small businesses have given back to their communities in countless ways – whether it was sponsoring the local kids’ soccer team or raising money for charity,” said O’Toole. “A Conservative government will have their backs and ensure we secure the future for Canada’s Main Streets.”

Backgrounder

Rebuilding Main Street

Canada’s Conservatives will help rebuild Main Streets across Canada and give small businesses the support they need to get back on their feet by:

1. Canada’s Conservatives will launch the Rebuild Main Street Tax Credit.

- This will provide a 25 per cent tax credit on amounts of up to $100,000 that Canadians personally invest in a small business over the next two years.

- This will give a strong incentive for Canadians to invest their money to help entrepreneurs rebuild our country.

2. Launching the Main Street Business Loan to provide loans of up to $200,000.

- The $60,000 Canada Emergency Business Account (CEBA) loan is too small for thousands of small and medium businesses.

- Canada’s Conservatives will immediately offer a “super-CEBA”, loan of up to four months of pre-pandemic revenue, up to a maximum of $200,000.

- The qualification criteria and terms will be similar to the CEBA.

- Up to 25 per cent will be forgiven depending on a company’s revenue loss.

3. The Canada Investment Accelerator refundable tax credit for small business will provide a five per cent investment tax credit for any capital investment made in 2022 and 2023.

- This is on top of the existing accelerated depreciation measures that will remain in place, compounding the tax advantages of working in Canada.

- The first $25,000 of the tax credit will be refundable for small businesses.

4. Canada’s Conservatives will also:

- Reform the Business Development Bank of Canada (BDC) to ensure that its loan programs are accessible to small businesses.

- This will include broadening BDC’s mandate to have it guarantee a portion of loans that Canada’s banks make to small business, in the same way that the Canada Mortgage and Housing Corporation guarantees mortgages.

- Look for ways to make it easier to start a business and reduce the time that entrepreneurs spend dealing with government when they should be concentrating on their business.

- Fix the mortgage stress test to stop discriminating against small business owners, contractors, and other non-permanent employees including casual workers.