THE Conference Board of Canada Senior Economist Richard Forbes noted on Wednesday: “Today, the Bank of Canada held its policy interest rate steady and announced that it will continue with its quantitative easing program. With core inflation below its target of two per cent and economic activity still well below pre-pandemic levels, today’s announcement was expected. Looking ahead, we anticipate the central bank to remain on the sidelines in terms of interest rate hikes until 2023.”

Insights:

* The Bank of Canada held its target for the overnight rate steady at 0.25 per cent today as the Canadian economy still has a long road ahead to recover from the pandemic. Today’s decision was expected.

* In addition to the interest rate announcement, the Bank stated that it will continue its quantitative easing program, whereby it purchases a minimum of $5 billion per week of federal government bonds.

* Year-over-year inflation in July was almost zero, due largely to weaker prices for energy and travel services. Measures of core inflation—which excludes food and energy prices—are between 1.3 and 1.9 per cent, below the Bank’s target of 2 per cent.

* The central bank reiterated today that the policy rate will remain at its effective lower bound of 0.25 per cent until a two per cent inflation target is sustainably achieved.

* The Bank notes that the Canadian economy rebounded more than anticipated in July, supported by government programs such as CERB and CEWS. Still, the Bank expects a slow and uneven economic recovery, much like our latest Canadian economic outlook.

* On a positive note, the Bank of Canada continues to find that core funding markets are functioning well. Earlier this year, the Bank released its Financial System Review, concluding that Canada’s financial institutions have sufficient buffers to cope with the current economic crisis. That has led to a decline in the use of the Bank’s short-term liquidity programs aimed at the financial sector.

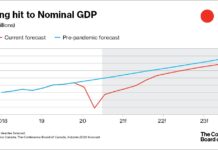

* Today’s release supports our forecast that interest rates will remain rock bottom beyond the short-term. We anticipate the Canadian economy will not fully recover from the COVID-19 crisis until late 2022, encouraging the central bank to hold its policy interest rate at 0.25 per cent until 2023.