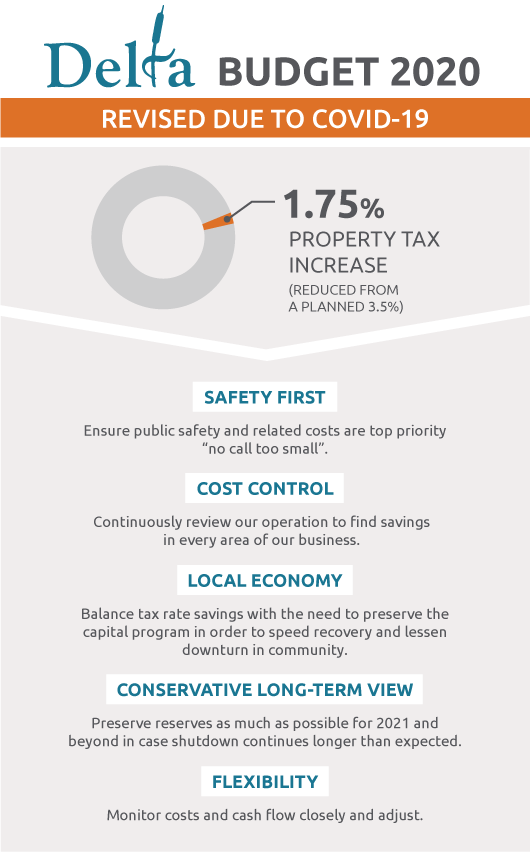

DELTA Council on April 27 adopted the 2020 to 2024 Financial Plan, which sets the City’s budget for 2020. The revised budget reduces the property tax increase from a planned 3.5% to 1.75%, which provides some financial relief for residents and businesses while also ensuring sufficient funding for base service levels.

This 1.75% increase equates to $4 a month or $48 per year for a property assessed at $1 million. In response to anticipated revenue losses as a result of the pandemic, the revised budget represents an overall decrease of approximately $13 million in the City of Delta’s total 2020 Financial Plan.

The City said it continues to work hard during these difficult times to offer as many services as possible that can be provided safely. Public safety remains the top priority, as well as core services to ensure City infrastructure continues to function effectively. City services continue to be key in supporting the sacrifices the entire community is making to limit the spread of COVID-19 as well as the recovery period that will follow.

In advance of preparing the budget, the City has already undertaken strong measures to address concerns about cash flow as a result of the COVID-19 pandemic:

- A freeze on discretionary spending.

- Approximately 540 auxiliary and temporary staff laid off.

- No new staff hires unless essential.

- Redeployment of existing staff to support critical services.

- Prioritization and delay of budgeted capital spending.

- Reducing staff overtime.

- Equipment purchases frozen unless deemed essential.

In light of these steps and broader economic issues impacting the City, the revised 2020 budget was developed using the following basic principles:

- Safety first – Ensure public safety and related costs are top priority “no call too small”.

- Cost control – Continuously review our operation to find savings in every area of our business.

- Local economy – Balance tax rate savings with the need to preserve the capital program in order to speed recovery and lessen downturn in community.

- Conservative long-term view – Preserve reserves as much as possible for 2021 and beyond in case shutdown continues longer than expected.

- Flexibility – Monitor costs and cash flow closely and adjust.

Delta Mayor George V. Harvie said on Tuesday: “While I am very disappointed to not be embarking on some of the tremendous projects we had planned for 2020, I know that staff have done everything possible to reduce the tax burden on the community while still providing vital investment in the economy and public safety. These steps are necessary to ‘keep the lights’ on while ensuring our no-call-too-small service level for emergency response. In addition, this positions us well for the uncertainties of 2021 and beyond while allowing us to lead the local economic recovery. We look forward to undertaking some of the deferred initiatives at a later date, but until then it is important to continue our efforts in limiting the spread of COVID-19 and supporting the community through these difficult times. This budget reflects these new priorities.”

The City of Delta said it remains committed to supporting residents and businesses who are encountering challenges in paying utility fees and property taxes. Council previously extended the utility fee penalty deadline from after March 31 to after June 1.

Delta is actively working on the potential to extend the property tax penalty date to provide some relief for those who need it. For those able to pay on time, it will still be important to do so to ensure sufficient funds are available to support first responders and core services. The Provincial Government also operates a property tax deferment program that ensures the City receives the necessary property taxes, but allows those eligible to defer their payment.

For more information about the revised 2020 budget, view the Council Report. Visit the City’s website at Delta.ca/coronavirus for updates on Delta’s response to COVID-19.