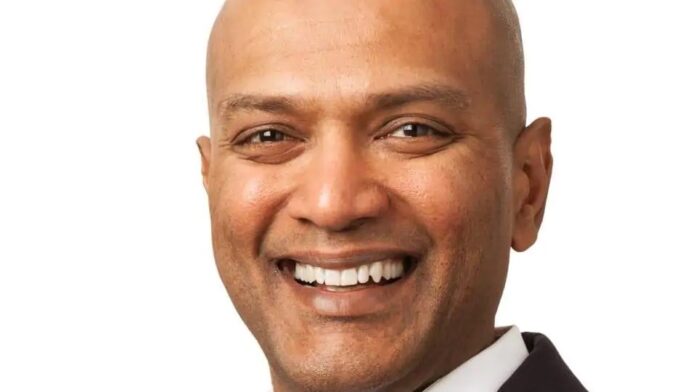

MUKUND Mohan, 48, of Clyde Hill, Washington, a tech executive, was taken into custody on July 23 and charged with fraudulently seeking over $5.5 million in Paycheck Protection Program (PPP) loans and laundering the proceeds, according to an announcement by Acting Assistant Attorney General Brian C. Rabbitt at of the Justice Department’s Criminal Division and U.S. Attorney Brian T. Moran of the U.S. Attorney’s Office for the Western District of Washington.

Mohan was charged by criminal complaint in the Western District of Washington with one count of wire fraud and one count of money laundering.

Mohan is the chief technology officer at Vancouver-based BuildDirect.com Technologies Inc., a website that connects people with home contractors. He had earlier worked for Amazon.com Inc. and Microsoft Corp., according to his LinkedIn profile.

According to the Times of India newspaper, he studied computer science in Mysore University in India. He moved to Bengaluru from the U.S. in 2008 to start a venture and then led Microsoft’s startup accelerator program. In 2014, he returned to the U.S. with a new role in Microsoft and left the company the following year. He worked for Amazon between 2016 and 2018 as director of product management, according to his LinkedIn profile. He lists a number of startups he’s part of.

The U.S. criminal complaint alleges that Mohan submitted at least eight fraudulent PPP loan applications on behalf of six different companies to federally insured financial institutions. The complaint alleges that, in support of the fraudulent loan applications, Mohan made numerous false and misleading statements about the companies’ respective business operations and payroll expenses.

The complaint also alleges that, in further support of the fraudulent loan applications, Mohan submitted fake and altered documents, including fake federal tax filings and altered incorporation documents. For example, Mohan misrepresented to a lender that, in 2019, his company Mahenjo Inc., had dozens of employees and paid millions of dollars in employee wages and payroll taxes. In support of Mahenjo’s loan application, Mohan submitted incorporation documents showing that he incorporated the company in 2018 and filed federal unemployment tax forms for 2019. In truth, Mohan purchased Mahenjo on the Internet in May 2020 and, at time he purchased the company, it had no employees and no business activity. The incorporation documents he submitted to the lender were altered and the federal tax filings he submitted were fake.

The complaint further alleges that Mohan transferred at least $231,000 in fraudulently-obtained loan proceeds to his personal brokerage account for his personal benefit.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act is a federal law enacted March 29. It is designed to provide emergency financial assistance to millions of Americans who are suffering the economic effects resulting from the COVID-19 pandemic. One source of relief provided by the CARES Act is the authorization of up to $349 billion in forgivable loans to small businesses for job retention and certain other expenses through the PPP. In April 2020, Congress authorized over $300 billion in additional PPP funding.

The PPP allows qualifying small businesses and other organizations to receive loans with a maturity of two years and an interest rate of one percent. Businesses must use PPP loan proceeds for payroll costs, interest on mortgages, rent and utilities. The PPP allows the interest and principal to be forgiven if businesses spend the proceeds on these expenses within a set time period and use at least a certain percentage of the loan towards payroll expenses.

A criminal complaint is merely an allegation and all defendants are presumed innocent until proven guilty beyond a reasonable doubt in a court of law.

Comments are closed.