IT’S one of the oldest tricks in the scammer playbook: Posing as a Canada Revenue Agency employee and trying to trick people into revealing their personal information or paying real money towards fake debts.

But even if you’re wise to the scammers’ traditional tactics, there always seems to be a new twist in their techniques that could catch you off guard, warns TJ Madigan, Canada Revenue Agency’s Western Region spokesperson.

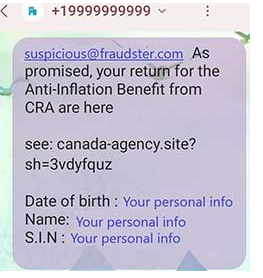

Within the past few weeks, The Canadian Anti Fraud Centre has reported a new texting scam. It looks like the usual fake text message, pretending to be from the CRA and asking you to click a link to pay a tax bill – but this message actually includes the recipient’s real name and real Social Insurance Number. Understandably, seeing their name and SIN in a text message can cause people to let their guard down — and that’s when the scammers strike.

Madigan says that CRA is also seeing a new tax scheme aimed at newcomers to Canada, taking advantage of the fact that they may be less familiar with Canada’s benefits system. In this case, the people behind the scheme pose as a financial advisor or some kind of tax expert. They offer to help newcomers to access extra benefits and credits, covering the time before they moved to Canada — often in exchange for a fee or a percentage of the benefits. Ultimately, the newcomer is on the hook to repay the benefits, and the promoter of the scheme has disappeared.

Even the methods scam artists are using continue to change. It’s not just emails, calls, and texts anymore. Shady scammers are using WhatsApp, Facebook Messenger, and other social media services in an effort to snare unsuspecting victims. They even create phoney web pages that are designed to look just like the real CRA website.

Madigan says that with these tax-related scams constantly evolving and becoming more sophisticated, CRA knows it can be tough to stay on top of it all. The good news is that there are definitely a few big red flags to keep an eye out for; things that will tell you for sure that an unexpected message is from a scammer and not a real CRA employee.

Is the person who contacted you pressuring you to make an immediate payment? Are they being extremely aggressive or threatening you with arrest? Asking you to send money using gift cards, cryptocurrency, or e-Transfer? These are all 100% tell-tale signs of a scam. If any of these things are happening, you’re not in contact a real CRA employee. Hang up; Ignore; Delete, delete, delete!

If you receive an unexpected message from the CRA and you’re being asked to click on a link, don’t do it — it’s not us. The CRA doesn’t ever use text messages or instant messages to start a conversation with you about your taxes, benefits, or account. We will also never send personal information — like tax refund amounts or balances owing — over text, IM, or email. If a message says it’s from the CRA but it includes a specific dollar figure, it’s definitely a scam.

But even with all this advice, Madigan says CRA knows it can sometimes be hard to tell whether the real CRA is trying to contact you – particularly as the scams are getting sneakier. So, if a situation comes up where you just can’t tell for sure, what do you do?

“Well, first of all, don’t give any personal information and don’t click on any links. If it’s a call, you can hang up; if it’s a message or email, don’t reply. Instead, reach out to the CRA through our publicly available phone numbers and we can verify whether we’re trying to get in touch with you. You can also investigate the situation on your online CRA account,” adds Madigan.

Of course, there are some situations where the CRA may genuinely need to reach out to you by phone, but it’s always okay to take the time to verify that you’re not talking to a scammer. If this means hanging up and calling the CRA back on its general phone number, that’s fine. You’ll never be penalized for making sure you’re speaking to a real CRA agent.

Ultimately, the best way to protect yourself from becoming a victim of fraud is to be aware, be educated, and be smarter than the scammers.

Remember to always be cautious when you receive unexpected contact from someone claiming to represent the CRA.

And remember that if someone is selling you something that sounds too good to be true… it probably is.